Professional Membership In Banking.

Training & Consultancy.

Professional Membership In Banking.

Professional Banking Qualifications.

Training & Consultancy.

KNOWLEDGE .

TRUTH .

PRUDENCE

Welcome To Kenya Institute of Bankers.

The Kenya Institute of Bankers is the “Professional umbrella body” for the Banking and Finance sector in Kenya with a membership of 40 banks and Financial Institutions as corporate members and their employees as individual members. The Institute’s primary responsibility is to uphold

the integrity of the Banking profession by promoting Acceptable Banking Standards by certifying professional banking education, training and providing consultancy/counselling, codes of conduct and continuing professional development

programmes.

KNOWLEDGE .

TRUTH .

PRUDENCE

Welcome To Kenya Institute of Bankers.

The Kenya Institute of Bankers is the “Professional umbrella body” for the Banking and Finance sector in Kenya with a membership of 40 banks and Financial Institutions as corporate members and their employees as individual members. The Institute’s primary responsibility is to uphold the integrity of the Banking profession by promoting Acceptable Banking Standards by certifying professional banking education, training and providing consultancy / counselling, codes of conduct and continuing professional development programmes.

Join

Our Professional

Membership.

40+

years in the business

Bronze Membership

Explore

Become A Member.

Register to be a Bronze Member.

Platinum Membership

Explore

Become A Member.

Register to be a Platinum Member.

Silver Membership

Explore

Become A Member.

Register to be a Silver Member.

Associate Membership

Explore

Become A Member

Register to be an Associate Member.

Join

Our Professional

Membership.

40

years in the business

Bronze Membership

Explore

Become A Member.

Register to be a Bronze Member.

Silver Membership

Explore

Become A Member.

Register to be a Silver Member.

Gold Membership

Explore

Become A Member.

Register to be a Gold Member.

Platinum Membership

Explore

Become A Member.

Register to be a Platinum Member.

Associate Membership

Explore

Become A Member

Register to be an Associate Member.

Fellow

Explore

Become A Member

Register to be a Fellow

KIB Banking Quiz

Event scheduled for June 2024

East African Banking School

2024 Edition to be held in Kampala, Uganda

KIB Interbank Sports 2024

Event scheduled for September 2024

KIB Cybersecurity Conference

Event Scheduled for October 2024

KIB Annual Dinner

Event Scheduled for November 2024

Click Below to access KIB News Updates...

Our

Professional

Courses

Membership

The Institute provides membership services to it's members in various membership levels. Each membership level has distinctive benefits accorded to members.

Training & Consultancy

The Institute undertakes a broad range of Short Courses and Consultancy services for the banking sector.

Professional Qualifications

The Institute offers professional qualifications leading to the award of Diploma and Advanced Diploma in banking and financial services.

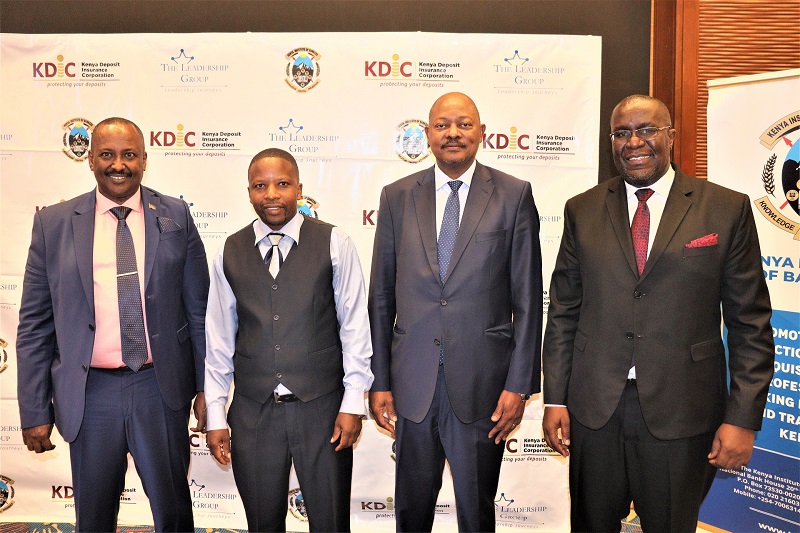

OUR PARTNERS

Kenya Institute of Bankers works closely with 40 banks and financial institutions in promoting continuous professional development in the Banking Sector within Kenya.